Bookkeeping & VAT (2024)

Now in 2024, I am still wrestling with how to effectively incorporate VAT in a spreadsheet bookkeeping system. This article is based on two Dutch single-owned (ZZP) administrations that I maintain:

- An IT/marketing service company. Customers are located in NL (always 21%), suppliers worldwide

- An art production company. Customers in NL (21%) and mostly outside EU (0% VAT). Hardly any suppliers.

One nett account or multiple accounts?

One account

In a bookkkeeping system, some entities have just one account, for both additions and subtractions. An example is the account Private withdrawal: It's used for withdrawing money from the business, but in the rare situations that I need to shore up finances, I use this same account to transfer money from private to business - And it works fine.

The problem is, that you can't see how much VAT is due for the next period, because the account VAT Due NL High also contains the numbers submitted to the Belastingdienst:

Accounts Revenue Accounts VAT Due Mutation receivable NL High payable NL High --------------------- ---------- ------- -------- ------- Sales 2023-05 Bob € 1,210 € 1,000 € 210 VAT submission 2023Q2 € 159 - € 159 --------------------- ---------- ------- -------- ------- Sum € 1,210 € 1,000 € 159 € 51

Two accounts

Some entities have different accounts, depending on whether transactions are positive or negative. Accounts receivable and Accounts payable is probably the best example. Rather than knowing the nett difference, I want to be able to track each entity on its own.

Here is an example of how this could be applied to VAT Due NL High.

VAT Due

Accounts Revenue Accounts VAT Due NL High

Mutation receivable NL High payable NL High Submitted

--------------------- ---------- ------- -------- ------- ---------

Sales 2023-05 Bob € 1,210 € 1,000 € 210

VAT submission 2023Q2 € 159 - € 159

--------------------- ---------- ------- -------- ------- ---------

Sum € 1,210 € 1,000 € 159 € 210 - € 159

It only seems so strange that amounts at VAT Due NL High Submitted are negative. Some thoughts:

- These are just the earlier substractions to VAT Due NL High but moved to a column of their own

- They submitted amounts do effectively lower the number for VAT Due NL High, so it isn't that strange

- Maybe move VAT Due NL High Submitted to the other side of the sheet, so figures become positive again? Let's keep it where it is: Next to the 'non-submitted' varian

Conclusions

Use two accounts per entity.

Various

VAT submission is more than copying some figures

The data that is needed for VAT submissions, is not a matter of just copying some figures from the bookkeeping:

- When VAT is done per quarter, figures will be sums over those three months. Additionally:

- 4a - purchases non-EU - revenue is a sum comprising several accounts

- 4b - purchases EU - revenue is a sum comprising several accounts

Don't use same names as on VAT submissions

Maybe kinda weird remark, but I fing it quite messy to use the exact same wording as what the Belastingdienst uses on their VAT submission webforms.

Separate sheet for VAT

Probably best to have a separate sheet for tracking VAT, rather than including it on the All sheet as done so far: Somehow that feels like shoehorning it.

Review: VAT submission

It's the VAT submission at the Belastingdienst website, where everything comes together. So let's review what's needed there:

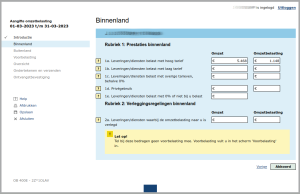

Page 2: Domestic achievements

| Category | Fields | Name & Description | Consequences concerning bookkeeping |

|---|---|---|---|

| 1 - Domestic achievements | 1a:

|

Domestic achievements - High Domestic revenue (without VAT) charged at high VAT rate and corresponding VAT amount. There is no distinction between services and products here |

This is basically the sum of the bookkeeping fields Revenue NL High over the designated period |

| 1 - Domestic achievements | 1b | Domestic achievements - Low As 1a, but now when the lower VAT rate is applied, e.g., for sales of original art work (which has never happened so far) → Not relevant |

Not relevant |

| 1 - Domestic achievements | 1c | Domestic revenue - Other | Not relevant |

| 1 - Domestic achievements | 1d | Private use | Not relevant |

| 1 - Domestic achievements | 1e | Domestic revenue - 0% or similar | Maybe I have a situation where this applies: In 2022, I received a deposit for office space that I used to rent. I had forgotten to include it on my balance sheets in the intermediate years, hence I have to book it as profit. However, I am also sure that it doesn't involve any VAT → Use this post at submission |

| 2 - Reverse domestic VAT | 2a | Reverse domestic VAT | Not relevant |

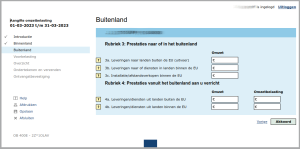

Page 3: Abroad

| Category | Fields | Name & Description | Consequences concerning bookkeeping |

|---|---|---|---|

| 3 - Achievements abroad | 3a | Products exported outside EU

|

Not relevant |

| 3 - Achievements abroad | 3b | Products/services exported inside EU

|

Not relevant |

| 3 - Achievements abroad | 3c | Distance sales EU | Not relevant |

| 4 - Purchases from abroad | 4a:

|

Purchases non-EU

|

|

| 4 - Purchases from abroad | 4b:

|

Purchases EU | Yes - Same as 4a |

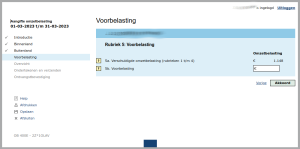

Page 4: Pretax

| Category | Field | Name & Description | Consequences concerning bookkeeping |

|---|---|---|---|

| 5 - Pretax | 5a | Due VAT categories 1-4 This is simply the sum of due VAT from earlier categories - You can't enter anything here. Not relevant |

-- |

| 5 - Pretax | 5b | Pretax The pretax that has been incured by the company. It's the sum of these entities - These are all internal entities. Belastingdienst only wants to know the sum:

|

See below |

Accounts & checklist

From the tables in the previous chapter, we end up with the following accounts. These are all the accounts that are needed, both for the Art Business and the IT/marketing business. Note how few accounts these actually are:

| Category & field | Code | Account | Notes |

|---|---|---|---|

| 1a - Achievements NL - High | 1a.1 | Revenue NL High | |

| 1a.2a | VAT Due NL High | ||

| 1a.2b | VAT Due NL High Submitted | ||

| 4a - Purchases non-EU | 4a.1 | Separate account for each non-EU supplier | The sum at 4a.1 needs to be filled in at 4a. Leveringen/diensten uit landen buiten de EU - Omzet. This figure is regardless whether such a product/service would be charged with VAT in NL (e.g., non-EU banking costs) |

| 4a.2a | VAT Due Non-EU | ||

| 4a.2b | VAT Due Non-EU Submitted | ||

| 4b - Purchases EU | 4b.1 | Separate account for each EU supplier | Again: This is regardless whether these purchases would involve VAT if they were domestic (e.g.: Costs of EU bank would be free of VAT domestically) |

| 4b.2a | VAT Due EU | ||

| 4b.2b | VAT Due EU Submitted | ||

| 5b - Pretax | 5b.1a | Pretax NL | Concerning purchases abroad, the VAT according to the NL system, should be added to both VAT Due and Pretax - Hence these non-NL pretax accounts |

| 5b.1b | Pretax NL Submitted | ||

| 5b.2a | Pretax EU | ||

| 5b.2b | Pretax EU Submitted | ||

| 5b.3a | Pretax non-EU | ||

| 5b.3b | Pretax EU Submitted |