Profit Equation

There are at least two ways to calculate profit (winst) at the annual accounts (jaarrekening) and they need to match:

- Through the usual P&L statement

- The second approach is discussed in this article.

I was first involuntarily confronted with this equation, when entering data concerning an annual account at the site of Belastingdienst. The site pointed out that these two methods of calculating profit, didn't match:

- Het saldo fiscalewinstberekening is niet gelijk aan het saldo winst-en-verlisrekening of winstaandeel van uw onderneming. Controleer de bedragen.

In this article (actually all articles concerning bookkeeping on this site), an eenmanszaak is assumed.

The formula - Left side and ride side should match:

{Equity increase} + {withdrawals} = {Profit} <=>

{Closing equity} - {Opening equity} + {withdrawals} = {Profit} <=>

{Asset increase} - {liabilities increase} + {withdrawals} = {profits}

{Closing assets} - {closing liabilities} - {opening assets} + {opening liabilites} + {withdrawals} = {profit} <=>

In Dutch:

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

The name of the game - Dutch

I'm still not sure how this formula is called, either in Dutch or in English.

At least, I'm quite sure it's not called [balansvergelijking].

Verandering Eigen Vermogen

Deze site doesn't give it a name, but states

- De verandering van het eigen vermogen is als volgt

Vermogensvergelijking

Dit is 'm: Vermogensvergelijking, ook wel kapitaalsvergelijking genoemd:

- https://nl.wikipedia.org/wiki/Vermogensvergelijking

- https://www.higherlevel.nl/forums/topic/8149-saldo-fiscalewinstberekening-saldo-winst-en-verliesrekening/

The name of the game - English

Balance Sheet Equation?

Maybe it's just an application of the familiar balance sheet equation?

{Equity increase} + {nett withdrawals} = {Profit according to income statement}

I doubt this.

Equity Reconciliation Formula

Sounds nice, but an online search doesn't confirm this name

Owner's Equity Reconciliation

Reconciliation of net worth

This seems a statement or document and not so much just a formula [1]

Statement of changes in equity

Again, a statement, rather than a formula, but it's getting close: [2], [3]

→ Statement of owner's equity

Statement of changes in owner's equity

→ Statement of owner's equity

Statement of Owner's Equity

Accountingtools.com calls this Statement of Owner's Equity, also called statement of changes in owner's equity. It looks promising:

- Although it's called a statement, the example that they show is really just one formula

- It's mentioned that this specifically applies to sole proprietorship

- It comes close to the formula at the beginning of this articele, but not entirely.

beginning capital balance + income - withdrawal = ending capital balance

Sources

- https://www.accountingtools.com/articles/statement-of-owners-equity.html

- https://www.deskera.com/blog/statement-of-owners-equity/

- https://spscc.pressbooks.pub/acct202working/chapter/prepare-an-income-statement-statement-of-owners-equity-and-balance-sheet/ - Nice article

- https://corporatefinanceinstitute.com/resources/valuation/owners-equity/

Equity equation

By now (2024.07), I'm quite sure about the Dutch name vermogensvergelijking. This would translate to equity equation, and I quite like that. It's also quite close to the maybe more accurate but disturrrbingly long name statement of owner's equity .

The only problem with this name: It's too close to balance sheet equation. Maybe not in name, but surely in description.

Example - Start easy

Let's run a simple example to see this in action:

- Company A is started in 2022

- It provides services, has no direct or indirect costs.

Booking facts

All booking facts (if that's the correct name) during this year:

- An invoice of € 1.000 (ex. 21% VAT) has been send to customer B

- Payment has been received on A's business account

- Half the amount has been retained and half withdrawn

- VAT has been disbursed to Belastingdienst.

Balance beginning of the year

Balance at the beginning of this year: 0 - 0 at both sides

Balance at the end of the year

- Balance business account: € 500

- No debt/foreign capital (vreemd vermogen)

- Equity formula: Equity = Assets - Liabilities [4] <=> Eigen vermogen = Bezittingen - Schulden

- In this case: Equity = € 500 - € 0 = € 500.

Resulting balance:

Debit Credit

------------------------------------------

Business account: € 500 | Equity: € 500

|

Total € 500 | Total € 500

Income statement

Easy:

Revenue (omzet): € 1.000 Direct costs (directe kosten): € 0 -------------------------------------------------- Gross profit (brutowinst): € 1.000 Indirect costs (indirecte kosten): € 0 -------------------------------------------------- Operational profit (operationale winst): € 1.000 Interest (rente) € 0 -------------------------------------------------- Profit (winst) € 1.000

I believe that withdrawals (onttrekking) shouldn't be incorporated in the income statement. Otherwise you could always depress profit by simply siphoning it off.

Profit calculations

Finally, we can apply the formula from the start of this article:

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

with

- Equity increase = € 500

- Nett withdrawals = € 500

- Profit according to income statement = € 1.000

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

€ 500 + € 500 = € 1.000

Notes:

- The calculation above confirms that the income statement should not include withdrawals

- Strange to see that withdrawals are not included in either balance or income statement

- Maybe this is why you need three documents to get a complete picture of a business' finance: Balance, Income statement and Cashflow statement: In the latter, withdrawals will be visible

- A balance is a snapshot of certain aspects of a business at a specific time, whereas a income statement is a statement over a time period. There's a analogy with electricity: current is at any one point where voltage is the difference over an interval. In physics, there are actually many such analogies and this isn't too remarkable

- Note that in this equation, all entities are of the interval-kind: The equity- and withdrawal-related entities are converted to interval-like. The income profit number is already interval-like

- Could all three entities be converted to point-like entities? I'm not sure: What would profit be as a point-like entity? - It doens't seem to make sense.

Example - Non-disbursed VAT

Now let's extend the example above with VAT not being disbursed to the Belastingdienst during this year

Booking facts

- An invoice of € 1.000 (ex. 21% VAT) has been send to customer B

- Payment has been received on A's business account

- Half the amount has been retained and half withdrawn

- VAT (€ 210) has been retained this year, and only disbursed in January of the next year

Balance beginning of the year

Balance at the beginning of this year is the same as before: 0 - 0 at both sides

Balance at the end of the year

- Balance business account: € 710

- There is debt to the Belastingdienst of € 210

- Equity formula: Equity = Assets - Liabilities [5] <=> Eigen vermogen = Bezittingen - Schulden

- In this case: Equity = € 710 - € 210 = € 500.

Resulting balance:

Debit Credit

------------------------------------------

Business account: € 710 | Debt: € 210

| Equity: € 500

------------------------| ----------------

Total € 710 | Total € 710

Income statement

The income statement is the same as before: VAT doesn't have anything to do with income statements.

Profit calculations

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

with

- Equity increase = € 500

- Nett withdrawals = € 500

- Profit according to income statement = € 1.000

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

€ 500 + € 500 = € 1.000

Notes:

- The profit calculation doesn't change

- Maybe because all entities are converted to interval-like entities, which is like the domain of the income statement, and VAT doesn't play here a role.

Finding the error

When submitting a jaarrekening at the website of Belastingdienst, the site uses this equation to check for errors. For one of the companies for which I do the bookkeeping, I had errors both for 2021 and 2022. In 2021, it took me about a week to fix it (because a lot of this stuff was new to me). For the 2022 jaarrekening, it only took me a couple of hours to fix it.

For the 2022 jaarrekening, it turned out that there were multiple errors at the closing balance sheet. The root cause of these: I used explicit numbers at the spreadsheet tab Closing balance, rather than links to figures at the All sheet.

Partitioning the Proft Equation into separate formulas for eacht month, helped to isolate the errors - See next chapter.

Partitioning

Maybe remember from Balance sheet that you cannot partition a year's balance sheet into 12 balance sheets, one for each month, and adding these 12 to get back at the original balance sheet? The reason for this: A balance sheet describes a moment in time, not an interval.

This is not the case for the Profit Equation: It is an 'interval entity'. Eventhough it refers to equity, it doesn't do so as a 'point entity', but as an 'interval entity', since it refers to the change in equity over a certain period - Quite neat, isn't it?

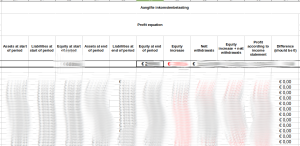

Some more details about the screen shot of the partitioning table here at the side:

- Figures Equity at end of a period are the same as those at Equity figures at the start of period for the next period. I calculated them each time anyway using a formula, to check that I didn't make any mistakes myself

- The same counts for the asset and liability figures: They repeat themselves, and I calculated them all through formulas, not through copying

- Errors in the closing balance sheet would reveal themselves, because the line for December would 'end' at different figures than the separate Closing balance sheet

- The same would could for errors in the opening balance: The line for the first month would have different figures than the separate Opening balance sheet

- For a while, I had a small difference of € 0,21 for the 2022 jaarrekening mentioned elsewhere, which was obviously a VAT submission rounding error (when doing submissions, you have to round off to whole euros, and you can decide whether to roung off or up). However, even that turned out to be an error in the Closing Balance Sheet: There was a hardcoded "€ 0" at Accounts payable , while at the All sheet, it was the actual € 0,21.

See also

Sources

- https://www.wallstreetmojo.com/equity-formula

- https://www.finler.nl/kennis/eigen-vermogen-ev

- https://corporatefinanceinstitute.com/resources/accounting/3-financial-statements-linked/

- https://www.higherlevel.nl/forums/topic/45391-saldo-fiscale-winstberekening-sluit-niet-aan-met-saldo-winst-en-verliesrekening/ - I'm not the only one confrontated with this puzzle