Profit Equation

There are at least two ways to calculate profit (winst) at the annual accounts (jaarrekening) and they need to match:

- Through the usual P&L statement

- The second approach is discussed in this article. I call it the Profite Equation, even after discovering that it's actually just an application of the Balance Sheet Equation.

I was first involuntarily confronted with this equation, when entering data concerning an annual account at the site of Belastingdienst. The site pointed out that these two methods of calculating profit, didn't match. In this article (actually all articles concerning bookkeeping), an eenmanszaak is assumed.

The formula - Left side and ride side should match:

{Equity increase} + {nett withdrawals} = {Profit according to income statement}

In Dutch:

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

The name of the game

I was struggling to figure out how it was called, until ChatGTP in 2023.08 pointed out that this is just an application of the usual Balance Sheet Equation (although ChatGPT can often be quite wrong):

- > In accounting or bookkeeping, you have this simple formula: {Equity increase} + {nett withdrawals} = {Profit according to income statement} Do you know how it is called?

- ChatGPT:

- The formula you're referring to is known as the "Accounting Equation" or the "Balance Sheet Equation." It's a fundamental concept in accounting that represents the relationship between a company's assets, liabilities, and equity. The equation is typically expressed as:

- Assets = Liabilities + Equity

- However, the formula you've provided seems to be a rearrangement of this equation to calculate equity changes based on profit and withdrawals. It can be derived from the main accounting equation as follows:

- Equity increase = Profit according to income statement - Net withdrawals

- This formula helps to show how changes in equity can be influenced by the company's profitability and owner's withdrawals. It's important to note that the accounting equation and related formulas are crucial for maintaining the balance between a company's financial elements and ensuring accurate financial reporting.

Example - Start easy

Let's run a simple example to see this in action:

- Company A is started in 2022

- It provides services, has no direct or indirect costs.

Booking facts

All booking facts (if that's the correct name) during this year:

- An invoice of € 1.000 (ex. 21% VAT) has been send to customer B

- Payment has been received on A's business account

- Half the amount has been retained and half withdrawn

- VAT has been disbursed to Belastingdienst.

Balance beginning of the year

Balance at the beginning of this year: 0 - 0 at both sides

Balance at the end of the year

- Balance business account: € 500

- No debt/foreign capital (vreemd vermogen)

- Equity formula: Equity = Assets - Liabilities [1] <=> Eigen vermogen = Bezittingen - Schulden

- In this case: Equity = € 500 - € 0 = € 500.

Resulting balance:

Debit Credit

------------------------------------------

Business account: € 500 | Equity: € 500

|

Total € 500 | Total € 500

Income statement

Easy:

Revenue (omzet): € 1.000 Direct costs (directe kosten): € 0 -------------------------------------------------- Gross profit (brutowinst): € 1.000 Indirect costs (indirecte kosten): € 0 -------------------------------------------------- Operational profit (operationale winst): € 1.000 Interest (rente) € 0 -------------------------------------------------- Profit (winst) € 1.000

I believe that withdrawals (onttrekking) shouldn't be incorporated in the income statement. Otherwise you could always depress profit by simply siphoning it off.

Profit calculations

Finally, we can apply the formula from the start of this article:

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

with

- Equity increase = € 500

- Nett withdrawals = € 500

- Profit according to income statement = € 1.000

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

€ 500 + € 500 = € 1.000

Notes:

- The calculation above confirms that the income statement should not include withdrawals

- Strange to see that withdrawals are not included in either balance or income statement

- Maybe this is why you need three documents to get a complete picture of a business' finance: Balance, Income statement and Cashflow statement: In the latter, withdrawals will be visible

- A balance is a snapshot of certain aspects of a business at a specific time, whereas a income statement is a statement over a time period. There's a analogy with electricity: current is at any one point where voltage is the difference over an interval. In physics, there are actually many such analogies and this isn't too remarkable

- Note that in this equation, all entities are of the interval-kind: The equity- and withdrawal-related entities are converted to interval-like. The income profit number is already interval-like

- Could all three entities be converted to point-like entities? I'm not sure: What would profit be as a point-like entity? - It doens't seem to make sense.

Example - Non-disbursed VAT

Now let's extend the example above with VAT not being disbursed to the Belastingdienst during this year

Booking facts

- An invoice of € 1.000 (ex. 21% VAT) has been send to customer B

- Payment has been received on A's business account

- Half the amount has been retained and half withdrawn

- VAT (€ 210) has been retained this year, and only disbursed in January of the next year

Balance beginning of the year

Balance at the beginning of this year is the same as before: 0 - 0 at both sides

Balance at the end of the year

- Balance business account: € 710

- There is debt to the Belastingdienst of € 210

- Equity formula: Equity = Assets - Liabilities [2] <=> Eigen vermogen = Bezittingen - Schulden

- In this case: Equity = € 710 - € 210 = € 500.

Resulting balance:

Debit Credit

------------------------------------------

Business account: € 710 | Debt: € 210

| Equity: € 500

------------------------| ----------------

Total € 710 | Total € 710

Income statement

The income statement is the same as before: VAT doesn't have anything to do with income statements.

Profit calculations

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

{Toename EV} + {Saldo onttrekking} = {Winst volgens resultatenrekening}

with

- Equity increase = € 500

- Nett withdrawals = € 500

- Profit according to income statement = € 1.000

{Equity increase} + {nett withdrawals} = {Profit according to income statement} <=>

€ 500 + € 500 = € 1.000

Notes:

- The profit calculation doesn't change

- Maybe because all entities are converted to interval-like entities, which is like the domain of the income statement, and VAT doesn't play here a role.

Finding the error

When submitting a jaarrekening at the website of Belastingdienst, the site uses this equation to check for errors. For one of the companies for which I do the bookkeeping, I had errors both for 2021 and 2022. In 2021, it took me about a week to fix it (because a lot of this stuff was new to me). For the 2022 jaarrekening, it only took me a couple of hours to fix it.

For the 2022 jaarrekening, it turned out that there were multiple errors at the closing balance sheet. The root cause of these: I used explicit numbers at the spreadsheet tab Closing balance, rather than links to figures at the All sheet.

Partitioning the Proft Equation into separate formulas for eacht month, helped to isolate the errors - See next chapter.

Partitioning

Maybe remember from Balance sheet that you cannot partition a year's balance sheet into 12 balance sheets, one for each month, and adding these 12 to get back at the original balance sheet? The reason for this: A balance sheet describes a moment in time, not an interval.

This is not the case for the Profit Equation: It is an 'interval entity'. Eventhough it refers to equity, it doesn't do so as a 'point entity', but as an 'interval entity', since it refers to the change in equity over a certain period - Quite neat, isn't it?

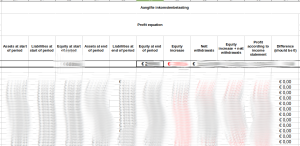

Some more details about the screen shot of the partitioning table here at the side:

- Figures Equity at end of a period are the same as those at Equity figures at the start of period for the next period. I calculated them each time anyway using a formula, to check that I didn't make any mistakes myself

- The same counts for the asset and liability figures: They repeat themselves, and I calculated them all through formulas, not through copying

- Errors in the closing balance sheet would reveal themselves, because the line for December would 'end' at different figures than the separate Closing balance sheet

- The same would could for errors in the opening balance: The line for the first month would have different figures than the separate Opening balance sheet

- For a while, I had a small difference of € 0,21 for the 2022 jaarrekening mentioned elsewhere, which was obviously a VAT submission rounding error (when doing submissions, you have to round off to whole euros, and you can decide whether to roung off or up). However, even that turned out to be an error in the Closing Balance Sheet: There was a hardcoded "€ 0" at Accounts payable , while at the All sheet, it was the actual € 0,21.

See also

Sources

- https://www.wallstreetmojo.com/equity-formula

- https://www.finler.nl/kennis/eigen-vermogen-ev

- https://corporatefinanceinstitute.com/resources/accounting/3-financial-statements-linked/

- https://www.higherlevel.nl/forums/topic/45391-saldo-fiscale-winstberekening-sluit-niet-aan-met-saldo-winst-en-verliesrekening/ - I'm not the only one confrontated with this puzzle